Facebook Blogging

Edward Hugh has a lively and enjoyable Facebook community where he publishes frequent breaking news economics links and short updates. If you would like to receive these updates on a regular basis and join the debate please invite Edward as a friend by clicking the Facebook link at the top of the right sidebar.

Friday, December 29, 2006

FDI Inflows and Outflows

This article from the Bangladesh Financial Express raises the rather interesting question as to why India is now investing abroad more in the form of FDI that it is receiving:

Despite persistent poverty and income disparities, 2006 marks the point when, 60 years after independence from colonial rule, Indians were investing more abroad than the country was receiving as foreign direct investment (FDI).

With India's foreign-currency reserves now exceeding US$160 billion and with a pro-liberalisation federal government relaxing norms for Indian firms acquiring hard currency for investments abroad, the amount of money invested by local corporate bodies outside India is expected to exceed $8 billion during the current calendar year. As of April-October, FDI flows touched $6.1 billion, compared with $2.6 billion during the first eight months of the previous fiscal year.

Now I think there is often an underlying confusion here, since Direct foreign investment is only one of the forms of capital inflow into India, since, as explained in this post, there is also institutional foreign investment (FII), and funds from non resident Indians (NRIs) to think about.The latter figure was $21 billion in 2005, that is over 3 times the level of FDI for 2006 alone (and lord knows what the level of NRI related inflows in 2006 are). On top of this domestic saving in India has been rising steadily.

So, as I keep pointing out, FDI is strategically, rather than quantitatively important, and exporting investment to make strategic acquisitions is also important.As Manoj Pant points out:

60% of world trade is intra-firm trade, and one way Indian companies are ensuring that their exports grow is to acquire firms abroad. "Through mergers and acquisitions, exporters ensure access to distribution channels as well as the latest technologies," he said, adding that this explains why Indian companies in industries such as steel, automotive components, pharmaceuticals and information technology (IT) are expanding abroad.

Despite persistent poverty and income disparities, 2006 marks the point when, 60 years after independence from colonial rule, Indians were investing more abroad than the country was receiving as foreign direct investment (FDI).

With India's foreign-currency reserves now exceeding US$160 billion and with a pro-liberalisation federal government relaxing norms for Indian firms acquiring hard currency for investments abroad, the amount of money invested by local corporate bodies outside India is expected to exceed $8 billion during the current calendar year. As of April-October, FDI flows touched $6.1 billion, compared with $2.6 billion during the first eight months of the previous fiscal year.

Now I think there is often an underlying confusion here, since Direct foreign investment is only one of the forms of capital inflow into India, since, as explained in this post, there is also institutional foreign investment (FII), and funds from non resident Indians (NRIs) to think about.The latter figure was $21 billion in 2005, that is over 3 times the level of FDI for 2006 alone (and lord knows what the level of NRI related inflows in 2006 are). On top of this domestic saving in India has been rising steadily.

So, as I keep pointing out, FDI is strategically, rather than quantitatively important, and exporting investment to make strategic acquisitions is also important.As Manoj Pant points out:

60% of world trade is intra-firm trade, and one way Indian companies are ensuring that their exports grow is to acquire firms abroad. "Through mergers and acquisitions, exporters ensure access to distribution channels as well as the latest technologies," he said, adding that this explains why Indian companies in industries such as steel, automotive components, pharmaceuticals and information technology (IT) are expanding abroad.

Investment and Growth In India

Following the last post it is perhaps just stopping to reflect a bit on what in fact people can invest in in India. Surfing around I found an excellent post from Balaji Viswanathan, which spells out much better than I can off the top of my head just why India's growth is not only sizzling away, but is about to move up to scorching:

First off Balaji starts with a gripe:

In the recent days, I'm pretty much disappointed with what economists forecast for India. I'm not rather disappointed at Indian growth, rather, I'm disappointed at the skills of the economists :P. I dont know whether they understand the whole picture and take all the information into account of what is happening to India.

I entirely agree. Most conventional economists simply do not get the big picture about what is happening in India and its significance.

Then Balaji puts up his own argument:

"I also read a gazillion articles of why people should invest in China, and why India is overheating, India will be affected by slow downs, India is just call-center centric, blah blah blah. Let me get around to my own understanding of what is happening."

He lists seven areas, all of them important, and I will summarise below, but best of all, go read in full:

1. Telecom - By far this is going to be the strongest sector for India in the next decade. In the last three years, our teledensity tripled and now we add 7 million mobile phones a month. At this rate we would move from our current presence of 180 million phones to over 250 million by 2007 and over 500 million by the end of this decade. This would place us head-head with China, and overtake US. Already, VSNL & Reliance's FLAG Telecom's hold the world's largest backbone telecom networks, (undersea cables & fiber optics handling most of Pacific & Atlantic lines) and this greater domestic clout will lead to greater buy outs in the saturated markets & bring more technology to India.

2. Metals & Infrastructure - While analysts always crib about the India's faltering infrastructure, not much of a note is taken when a single state (one of the poorest) secured over 40 deals for investments in this core sectors worth a whopping $100b in a year. Given cheap labor, low cost of procurement and abundance of resources, 100 billion might be worth half a trillion in this state of Orissa. And, with that Reliance is planning to build a 12GW plant (world's largest single power plant), POSCO, Mittal & Tata for massive steel capacity expansion, stunning Aluminium expansion by Vedanta industries et al. and port and road/rail link expansion by a combination of players. Since, this is a poor state such developments can lead to stunning growth and these players are already building a city foused on health care & IT.

3. Banking & Finance- Though often ridiculed, the government owned banks have moved a great deal in the last decade. From being indifferent and lethargic, their employees have increased their zeal in expanding further. Indian banks are among the healthiest in Asia with the lowest Non Performing Assets, and greater branch coverage.

4. Organized Retail - This is one sector that would be a killer application in the future, as they start from almost nil, and would soon have over $50 billion investment in the next couple of years. Reliance has setup a highly ambition project of over few thousand outlets & Malls, Bharti with its Walmart tieup is looking to do big, and other smaller players will try to outbeat them by going early.

5. Hoteling & Real Estate - Enough has been said about the fact that India has just as many hotel rooms as the New York City. While this is a disgrace, see it as a potential. As 99% of the market seems to be unutilized, with proper planning the hoteling industry can easily grow at 100% without reaching saturation for a long time.

6. Healthcare & Pharma- By now you should have heard that medical costs in India are among the lowest in the world. Thus, we have a huge potential for expanding this booming industry as more and more people can now afford medical facilities leadind to a huge domestic expanision, and a lot of countries are thinking about formally sending their patients to India for treatment. And, Indian pharma companies are leading a great expanision, and busy buying assets abroad and expanding R&D facilities. Thus, with greater middle class clout and prosperity, these two industries will have a massive growth as more people can get medical care, and more drug development will be done in India.

7. Auto - There was a time when blindly took outdated european car designs and manufactured small amounts of car for domestic use. The times are changing. In Chennai alone four major manufacturers are setting up huge factories, Tata Motors is world's one of the largest medium & heavy commercial vehicle producer & also eyeing for a $2000 car. In auto components, India is slowly becoming the world's largest manufacturer. With great domestic market growth & a potential for cost cutting using cheap labor & facilities, a lot of foreign majors like BMW, Nissan, Fiat are entering India, big time.

Lastly but by no means leastly, Balaji concludes with one point with whose spirit I again entirely agree: even if there is a global slowdown next year, India may even benefit due to its low exposure and the fact that cheap money would come flooding in.

A world recession can also indirectly benefit India, when its hungry entrepreneurs can get value buy outs at cheaper prices (like how VSNL & Reliance boughtout world's major telecom backbones like Tyco & FLAG). It would also hit upon the margins of international producers who might eye India for greater cost cutting, and Indian government would be more amenable to opening up to overcome the world recession. It would also make companies to look for the bigger & fast moving Indian market than the saturated world markets (like how Vodafone & Oracle are doing) and bring more investments. We benefitted from the American recession of 2001-02 (it increased outsourcing and cheapened telecom assets) and I guess we could now repeat the performance.

First off Balaji starts with a gripe:

In the recent days, I'm pretty much disappointed with what economists forecast for India. I'm not rather disappointed at Indian growth, rather, I'm disappointed at the skills of the economists :P. I dont know whether they understand the whole picture and take all the information into account of what is happening to India.

I entirely agree. Most conventional economists simply do not get the big picture about what is happening in India and its significance.

Then Balaji puts up his own argument:

"I also read a gazillion articles of why people should invest in China, and why India is overheating, India will be affected by slow downs, India is just call-center centric, blah blah blah. Let me get around to my own understanding of what is happening."

He lists seven areas, all of them important, and I will summarise below, but best of all, go read in full:

1. Telecom - By far this is going to be the strongest sector for India in the next decade. In the last three years, our teledensity tripled and now we add 7 million mobile phones a month. At this rate we would move from our current presence of 180 million phones to over 250 million by 2007 and over 500 million by the end of this decade. This would place us head-head with China, and overtake US. Already, VSNL & Reliance's FLAG Telecom's hold the world's largest backbone telecom networks, (undersea cables & fiber optics handling most of Pacific & Atlantic lines) and this greater domestic clout will lead to greater buy outs in the saturated markets & bring more technology to India.

2. Metals & Infrastructure - While analysts always crib about the India's faltering infrastructure, not much of a note is taken when a single state (one of the poorest) secured over 40 deals for investments in this core sectors worth a whopping $100b in a year. Given cheap labor, low cost of procurement and abundance of resources, 100 billion might be worth half a trillion in this state of Orissa. And, with that Reliance is planning to build a 12GW plant (world's largest single power plant), POSCO, Mittal & Tata for massive steel capacity expansion, stunning Aluminium expansion by Vedanta industries et al. and port and road/rail link expansion by a combination of players. Since, this is a poor state such developments can lead to stunning growth and these players are already building a city foused on health care & IT.

3. Banking & Finance- Though often ridiculed, the government owned banks have moved a great deal in the last decade. From being indifferent and lethargic, their employees have increased their zeal in expanding further. Indian banks are among the healthiest in Asia with the lowest Non Performing Assets, and greater branch coverage.

4. Organized Retail - This is one sector that would be a killer application in the future, as they start from almost nil, and would soon have over $50 billion investment in the next couple of years. Reliance has setup a highly ambition project of over few thousand outlets & Malls, Bharti with its Walmart tieup is looking to do big, and other smaller players will try to outbeat them by going early.

5. Hoteling & Real Estate - Enough has been said about the fact that India has just as many hotel rooms as the New York City. While this is a disgrace, see it as a potential. As 99% of the market seems to be unutilized, with proper planning the hoteling industry can easily grow at 100% without reaching saturation for a long time.

6. Healthcare & Pharma- By now you should have heard that medical costs in India are among the lowest in the world. Thus, we have a huge potential for expanding this booming industry as more and more people can now afford medical facilities leadind to a huge domestic expanision, and a lot of countries are thinking about formally sending their patients to India for treatment. And, Indian pharma companies are leading a great expanision, and busy buying assets abroad and expanding R&D facilities. Thus, with greater middle class clout and prosperity, these two industries will have a massive growth as more people can get medical care, and more drug development will be done in India.

7. Auto - There was a time when blindly took outdated european car designs and manufactured small amounts of car for domestic use. The times are changing. In Chennai alone four major manufacturers are setting up huge factories, Tata Motors is world's one of the largest medium & heavy commercial vehicle producer & also eyeing for a $2000 car. In auto components, India is slowly becoming the world's largest manufacturer. With great domestic market growth & a potential for cost cutting using cheap labor & facilities, a lot of foreign majors like BMW, Nissan, Fiat are entering India, big time.

Lastly but by no means leastly, Balaji concludes with one point with whose spirit I again entirely agree: even if there is a global slowdown next year, India may even benefit due to its low exposure and the fact that cheap money would come flooding in.

A world recession can also indirectly benefit India, when its hungry entrepreneurs can get value buy outs at cheaper prices (like how VSNL & Reliance boughtout world's major telecom backbones like Tyco & FLAG). It would also hit upon the margins of international producers who might eye India for greater cost cutting, and Indian government would be more amenable to opening up to overcome the world recession. It would also make companies to look for the bigger & fast moving Indian market than the saturated world markets (like how Vodafone & Oracle are doing) and bring more investments. We benefitted from the American recession of 2001-02 (it increased outsourcing and cheapened telecom assets) and I guess we could now repeat the performance.

FDI Flows In India

India is anticipating a substantial increase in FDI in 2007 (which is hardly surprising), indeed the government estimates that the 2006 figure could be doubled:

In a year-end review released this week, Kamal Nath, India’s minister of commerce and industry, said FDI inflows were expected to surpass $11bn in 2006-07, compared with $5.5bn the previous year.

However as the article also notes this figure is way below the Chinese one in absolute terms:

Foreign direct investment (FDI) in India this fiscal year is expected to double to $11bn but will still be dwarfed by inflows to neighbouring Asian countries such as China and Singapore,

So far, so good, but as Surjit Bhalla points out, you need to think about both FDI (foreign direct investment) and FII (foreign institutional investment), Rasmi Banga agrees:

"However, Rashmi Banga, an economist at the United Nations Conference on Trade and Development, based in New Delhi, pointed out that foreign investment could enter India through other channels such as foreign institutional investors (FII)."

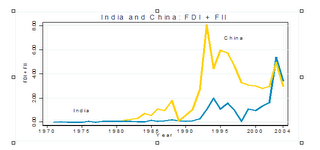

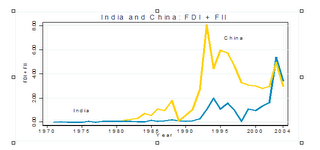

Now the interesting thing, as this chart from Surjit Bhalla shows is that the combined totals of FDI and FII for India and China as a proportion of GDP are not that different:

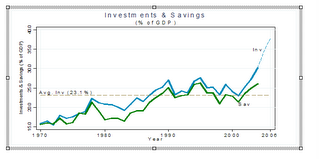

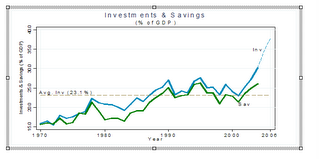

However, in addition to FDI and FII we also need to consider the domestic savings situation, and as we can see this has been on a long term secular rise in India for some time now:

Further there are inward capital flows from NRIs (non-resident Indians)to consider and India Economy Blogger Arjun Swarup:

The housing and real estate boom in India is being driven by NRI inflows into India. In 2005, the inflow was 90,000 crores ($21 billion). For China, which was the second biggest recipient, the number was $5 billion.

So individual flows into India are in fact much bigger than for China, and just why is there this difference, well Arjun suggests (and I'm sure he is right):

The reason for heavy NRI investment into real estate is that they would like to have a long-term view into India, given the upcoming demographic dividend, and the overall growth prospects. So they are buying and selling, creating the market. Additionally, it is the simplest (and safest) way to get a foot in the door right now.

It also needs to bear remembering that land prices in India can only appreciate over the long run ( high density, massive demand, growth concentrated in a few regions). Plus, zoning between commercial and residential areas in most high growth regions continues to be quite weak, and that also pushes up demand significantly.

So at the end of the day FDI is important more for strategic that for volume reasons, and it may be that India will have no shortage of funds for investment projects in 2007, in fact quite the contrary is likely to be the case.

Basically, as Nanuhbai explains in this post, India's per capita incomes can rise either by having a greater share of its population actively working in the cash economy, or by improving the productivity of those who are working, the former will happen almost automatically as funds of any description flow in (given the fairly favourable demographic backdrop) but the latter will only take place effectively (in the short term) through the transfer of technology and management expertise which becomes possible through FDI. This is why upping the volume of FDI is so important for India.

In a year-end review released this week, Kamal Nath, India’s minister of commerce and industry, said FDI inflows were expected to surpass $11bn in 2006-07, compared with $5.5bn the previous year.

However as the article also notes this figure is way below the Chinese one in absolute terms:

Foreign direct investment (FDI) in India this fiscal year is expected to double to $11bn but will still be dwarfed by inflows to neighbouring Asian countries such as China and Singapore,

So far, so good, but as Surjit Bhalla points out, you need to think about both FDI (foreign direct investment) and FII (foreign institutional investment), Rasmi Banga agrees:

"However, Rashmi Banga, an economist at the United Nations Conference on Trade and Development, based in New Delhi, pointed out that foreign investment could enter India through other channels such as foreign institutional investors (FII)."

Now the interesting thing, as this chart from Surjit Bhalla shows is that the combined totals of FDI and FII for India and China as a proportion of GDP are not that different:

However, in addition to FDI and FII we also need to consider the domestic savings situation, and as we can see this has been on a long term secular rise in India for some time now:

Further there are inward capital flows from NRIs (non-resident Indians)to consider and India Economy Blogger Arjun Swarup:

The housing and real estate boom in India is being driven by NRI inflows into India. In 2005, the inflow was 90,000 crores ($21 billion). For China, which was the second biggest recipient, the number was $5 billion.

So individual flows into India are in fact much bigger than for China, and just why is there this difference, well Arjun suggests (and I'm sure he is right):

The reason for heavy NRI investment into real estate is that they would like to have a long-term view into India, given the upcoming demographic dividend, and the overall growth prospects. So they are buying and selling, creating the market. Additionally, it is the simplest (and safest) way to get a foot in the door right now.

It also needs to bear remembering that land prices in India can only appreciate over the long run ( high density, massive demand, growth concentrated in a few regions). Plus, zoning between commercial and residential areas in most high growth regions continues to be quite weak, and that also pushes up demand significantly.

So at the end of the day FDI is important more for strategic that for volume reasons, and it may be that India will have no shortage of funds for investment projects in 2007, in fact quite the contrary is likely to be the case.

Basically, as Nanuhbai explains in this post, India's per capita incomes can rise either by having a greater share of its population actively working in the cash economy, or by improving the productivity of those who are working, the former will happen almost automatically as funds of any description flow in (given the fairly favourable demographic backdrop) but the latter will only take place effectively (in the short term) through the transfer of technology and management expertise which becomes possible through FDI. This is why upping the volume of FDI is so important for India.

Thursday, December 28, 2006

Punjab National Bank Raises Rates

This article was interesting, not least because it helps me to see how the Indian banking system actually works:

Punjab National Bank, India's third biggest by assets, said it increased the interest rate it charges its best customers by quarter percentage point be able to meet a requirement for lenders to hold more cash reserves.

The new prime lending rate of 11.75 percent will be effective Jan. 1, the New Delhi-based bank said in a statement to the Bombay Stock Exchange.

Indian lenders including the State Bank of India, ICICI Bank Ltd. and HDFC Bank Ltd., the nations' biggest by market value, have raised lending rates after the central bank told them to increase the proportion of deposits to be held as cash to 5.5 percent by Jan. 6 from 5 percent.

The Reserve Bank of India is trying to cool the pace of lending, which expanded 29 percent in the year to Dec. 8. In the fiscal year ended March 31 bank lending increased by more than 35 percent, close to the previous year's expansion.

Punjab National's loans expanded 29 percent to 823 billion rupees as of Sept. 30. Outstanding retail credit expanded 48 percent to 198 billion rupees from a year earlier.

India's inflation rate accelerated to 5.32 percent in the week ended Dec. 9, compared with 5.16 percent in the earlier week. The central bank has set an inflation target of 5 percent to 5.5 percent for the year ending March 31.

Set up in 1895 in Lahore, now in Pakistan, Punjab National has more than 4,000 branches, the most after the State Bank of India. The bank is 57.8 percent owned by the Indian government.

Its shares, which rose 64 percent over the past six months, gained 1.8 percent or 9.05 rupees to 515.1 rupees on the Bombay Stock Exchange yesterday.

Punjab National Bank, India's third biggest by assets, said it increased the interest rate it charges its best customers by quarter percentage point be able to meet a requirement for lenders to hold more cash reserves.

The new prime lending rate of 11.75 percent will be effective Jan. 1, the New Delhi-based bank said in a statement to the Bombay Stock Exchange.

Indian lenders including the State Bank of India, ICICI Bank Ltd. and HDFC Bank Ltd., the nations' biggest by market value, have raised lending rates after the central bank told them to increase the proportion of deposits to be held as cash to 5.5 percent by Jan. 6 from 5 percent.

The Reserve Bank of India is trying to cool the pace of lending, which expanded 29 percent in the year to Dec. 8. In the fiscal year ended March 31 bank lending increased by more than 35 percent, close to the previous year's expansion.

Punjab National's loans expanded 29 percent to 823 billion rupees as of Sept. 30. Outstanding retail credit expanded 48 percent to 198 billion rupees from a year earlier.

India's inflation rate accelerated to 5.32 percent in the week ended Dec. 9, compared with 5.16 percent in the earlier week. The central bank has set an inflation target of 5 percent to 5.5 percent for the year ending March 31.

Set up in 1895 in Lahore, now in Pakistan, Punjab National has more than 4,000 branches, the most after the State Bank of India. The bank is 57.8 percent owned by the Indian government.

Its shares, which rose 64 percent over the past six months, gained 1.8 percent or 9.05 rupees to 515.1 rupees on the Bombay Stock Exchange yesterday.

Wednesday, December 27, 2006

China Also Wants To Use Reserves: For Energy

According to today's news China is thinking of trying to use some of its excess reserves to develop energy capacity:

China will take advantage of its massive foreign exchange reserves to expand its stock of strategic resources such as oil and minerals, state media reported Wednesday, citing a top economic official.

Vice Prime Minister Zeng Peiyan told leaders of the national legislature that the government plans to step up exploration for key resources such as oil, gas and coal. It also intends to use the opportunity afforded by the country's more than $1 trillion in foreign reserves to improve strategic resource bases, the state-run newspaper China Business News and other reports said.

This follows a report I mentioned last week that India plans to try and do something similar with reserves to pay for infrastructural development. As the article notes, it isn't by any means clear how this could be done in any satisfactory way:

The reports did not provide details on exactly how the government would use funds backed by the foreign exchange reserves, which cannot directly be used for such purposes because they belong to the central bank.

China will take advantage of its massive foreign exchange reserves to expand its stock of strategic resources such as oil and minerals, state media reported Wednesday, citing a top economic official.

Vice Prime Minister Zeng Peiyan told leaders of the national legislature that the government plans to step up exploration for key resources such as oil, gas and coal. It also intends to use the opportunity afforded by the country's more than $1 trillion in foreign reserves to improve strategic resource bases, the state-run newspaper China Business News and other reports said.

This follows a report I mentioned last week that India plans to try and do something similar with reserves to pay for infrastructural development. As the article notes, it isn't by any means clear how this could be done in any satisfactory way:

The reports did not provide details on exactly how the government would use funds backed by the foreign exchange reserves, which cannot directly be used for such purposes because they belong to the central bank.

Monday, December 25, 2006

Village Consumption in India

With all the talk about India's consumption-driven growth model one thing is obvious, roughly 70% of the Indian population - those who live in rural areas - have restricted incomes and aren't going to power any massive increase in economic growth in India in the near future. This is simply a product of the fact that such a very large number of people account for such a comparatively small part of total GDP.

Which is not to say that consumption won't increase in the rural areas. Bloomberg this week has drawn attention to a report from the Associated Chambers of Commerce and Industry of India:

India's consumer and household product companies will probably sell more goods in the country's villages and towns as rural incomes increase, a survey said.

Demand for products such as toothpaste, instant coffee and deodorants in the nation's villages and small towns will increase by 60 percent by 2012, said the Associated Chambers of Commerce and Industry of India, a New Delhi-based association of companies.

Now according to the report itself (which can be found here):

``The per capita income of rural and semi-urban populace will increase as the economic activities grow there due to government focus on their industrialization,''

Now I have no doubt that per capita incomes in the rural areas can grow with time, but I am not sure that matters are as simple as this statement suggests. Government may have the will to see rural per capita incomes rise, but having the will and getting your way are not necessarily the same thing. Of course spending on infrastructure will make many of India's rural areas more accessible, and thus more economically viable, but there are a whole number of issues knocking around in the background here, not least of them being who exactly is going to finance the village infrastructure.

Large infrastructural projects may well be possible with private sector financing in certain key areas (since these will largely be profitable), but these, as we have seen from the Chinese case, may in fact be highly concentrated.

Government financed projects will be much more constrained, since there is the whole question of the fiscal deficit issue to consider, this is why it would have been better that such a significant deficit had not been run up so quickly in recent years.

Indeed in some ways infrastructure may well follow economic activity, rather than the other way round, at this point, and the people - as we have seen in China - may move to the economic activity, rather than the economic activity moving to the people. Even in a European context - for example - regional development policy has often been a lot less successful than the planners would have hoped for.

The big issue is whether economic activity in the poorest areas can grow anything like fast enough to keep pace with rising population numbers. So we may see rural incomes rise in absolute terms - and thus demand for consumer products, whilst in fact per capita incomes may not grow anything like as fast.

All this being said, demand for these products - known as FMGCs - will of course continue apace, and investing in these areas should be a safe enough bet. It remains to be seen however whether the rate of growth in the rural areas is above (or below) the average for the economy as a whole during the next 5 to 10 years.

One last point: in a way there is something sad in the way all this is happening: Take this paragraph in the original report:

In view of ASSOCHAM, the urban pockets which currently are the biggest market size for all FMCG products, in next 4-5 years will switch over their consumption patterns for organic products to keep better their health, thus making an erosion in their present consumption patterns for FMCG products.

That is the urban middle classes are anticipated to exit many of the products whose consumption is expected to grow, and to do this for health reasons, while much of rural India seems destined to move directly from the threshold of malnutrition to the trap of diabetes and obesity. Talk about the chronicle of a tragedy foretold in advance. And this last point from Bloomberg itself:

Companies such as the local unit of Unilever and the country's biggest cigarette maker, ITC Ltd., are expanding their reach in the 638,000 villages and 3,784 towns with less than 100,000 people.

Which is not to say that consumption won't increase in the rural areas. Bloomberg this week has drawn attention to a report from the Associated Chambers of Commerce and Industry of India:

India's consumer and household product companies will probably sell more goods in the country's villages and towns as rural incomes increase, a survey said.

Demand for products such as toothpaste, instant coffee and deodorants in the nation's villages and small towns will increase by 60 percent by 2012, said the Associated Chambers of Commerce and Industry of India, a New Delhi-based association of companies.

Now according to the report itself (which can be found here):

``The per capita income of rural and semi-urban populace will increase as the economic activities grow there due to government focus on their industrialization,''

Now I have no doubt that per capita incomes in the rural areas can grow with time, but I am not sure that matters are as simple as this statement suggests. Government may have the will to see rural per capita incomes rise, but having the will and getting your way are not necessarily the same thing. Of course spending on infrastructure will make many of India's rural areas more accessible, and thus more economically viable, but there are a whole number of issues knocking around in the background here, not least of them being who exactly is going to finance the village infrastructure.

Large infrastructural projects may well be possible with private sector financing in certain key areas (since these will largely be profitable), but these, as we have seen from the Chinese case, may in fact be highly concentrated.

Government financed projects will be much more constrained, since there is the whole question of the fiscal deficit issue to consider, this is why it would have been better that such a significant deficit had not been run up so quickly in recent years.

Indeed in some ways infrastructure may well follow economic activity, rather than the other way round, at this point, and the people - as we have seen in China - may move to the economic activity, rather than the economic activity moving to the people. Even in a European context - for example - regional development policy has often been a lot less successful than the planners would have hoped for.

The big issue is whether economic activity in the poorest areas can grow anything like fast enough to keep pace with rising population numbers. So we may see rural incomes rise in absolute terms - and thus demand for consumer products, whilst in fact per capita incomes may not grow anything like as fast.

All this being said, demand for these products - known as FMGCs - will of course continue apace, and investing in these areas should be a safe enough bet. It remains to be seen however whether the rate of growth in the rural areas is above (or below) the average for the economy as a whole during the next 5 to 10 years.

One last point: in a way there is something sad in the way all this is happening: Take this paragraph in the original report:

In view of ASSOCHAM, the urban pockets which currently are the biggest market size for all FMCG products, in next 4-5 years will switch over their consumption patterns for organic products to keep better their health, thus making an erosion in their present consumption patterns for FMCG products.

That is the urban middle classes are anticipated to exit many of the products whose consumption is expected to grow, and to do this for health reasons, while much of rural India seems destined to move directly from the threshold of malnutrition to the trap of diabetes and obesity. Talk about the chronicle of a tragedy foretold in advance. And this last point from Bloomberg itself:

Companies such as the local unit of Unilever and the country's biggest cigarette maker, ITC Ltd., are expanding their reach in the 638,000 villages and 3,784 towns with less than 100,000 people.

India's Growth Path

My friend Aninda made a number of useful an interesting points to me in a recent mail.

"The real economic underpinnings for a sustained surge in productivityand capital deepening growth is there. But the political/policy underpinnings to manage such a referenced 'underpinning' along side socio-political and investor expectations, still, in my view, fall short."

Well this is the big issue isn't it. I don't think that any of us doubt the weaknesses on the policy front, the key problem seems to be just how much growth can be achieved despite this.

I mean if we call the rate of GDP growth Y*, then we could say something like this:

Y* = f(L*, EL*, T*, I*)

Where L is labour force, EL is effective labour force (ie a human capital component), T is the technology level, and I is a measure of institutional quality. Now the difficulty is just what weighting to we give to each of these. L isn't hard to estimate, since it is to some extent determined by the demographics, but obviously not by this alone, since the growth in labour participation will also to some extent be influenced by I, eg just how dynamic the labour market is and how good at job creation it is.

The others are much less easy to get to grips with. EL can be measured by changes in formal education, but in a rapidly growing economy like India's, and with a rapid expansion in unskilled jobs, learning by doing can be even more important, and again in the north of India maybe you need another proxy like H (health) to assess just what can and can't be done.

T will depend a lot on the investment rate, and this is what we will need to watch closely in 2007, but again there are reasons ex-India to imagine that the flow of funds can increase significantly, since the quantity of investment opportunities in relation to the availability of funds may be constrained (the investment dearth, which is simply the other side of the savings glut). So any assessment of trend growth in India would need to take into account the external environment, and how this is changing, and just how rapidly India is integrating with that global environment (which again, of course, depends on I*).

What we don't know is how rapidly the institutional environment can change, but one thing which should be borne in mind is the fact that a market economy is effectively a self-organising system. In an environment where so many people put the emphasis on markets, it is strange how people often tend to ignore this fact (or refer us to the law of unintended consequences). It is precisely because outcomes can RARELY be the intended ones that markets are so important, indeed this is the whole theoretical underpinning of the market economy case, and of course the basis for the critique of soviet-style planned economies (although, of course, don't miss what France has actually managed to do with a far higher planning element than the US).

Which is not at all to say that you don't need to develop a high quality institutional environment, but is to say that when the river is flowing fast enough, the water will simply work its way round the blockages. This is what we may be about to witness in India.

Also, if we look at the growth theory correlation studies of the 1990s, what is surprising is just how LITTLE correlation people were able to find about institutional factors, apart from Health (which was the strongest correlate) and education.

So I think we do need to be careful here.

"Here, too, excessive optmism needs to be tempered by India's rich history of mishaps, mismanagement, corruption, etc."

Well look, all of this is certainly true, but just how much of a guide to the future is the past here? Just how rapidly can things change? We simply don't know, but all the recent evidence points to the fact that things are changing much more quickly today - everywhere - than they were 20 years ago, for example. So if there are to be surprises here, oughtn't we to expect them on the upside?

"I believe it is incorrect to say India's politics do not matter

anymore, or that its economy is increasingly divorced from political or policy constraints. "

No, but I don't think that any of us are going quite that far, we are simply asking the fairly reasonable question of, even on the slightly worse case scenarios, what could we expect?

There is an unusual comparison here which springs to mind, since most of the analysts out there seem absolutely ready to buy the Goldilocks Germany and Japan stories, whilst not buying the Indian one. I would suggest they apply the same criteria to their analyses of Germany and Japan that they apply to India, not the other way round.

But why does this difference exist? I think it exists because people tend (following academic theory prejudices - Darren Acemoglu for eg , who IMHO simply hasn't got a clue what he is doing in the last life expectancy/fertility correlate he ran, but more on this in another moment) to give a high weighting in the little equation I outline above to the I factor, and don't think enough about the structural components of L* and EL*. You need to think about BOTH, but my big beef is that one set of parameters are being ignored here, and in BOTH the Japan and the India cases, which are really only two different sides of the same coin.

"Demand side growth, financial market valuations and social

expectations are in danger of pulling ahead of supply side capacities (and political commitments)."

I think we need to differentiate pretty rigourously when we refer to 'demand' here, as I have often pointed out to Brad Setser, you need to think about BOTH investment and consumer demand. Now I think we are all agreed that the consumer driven end of things has now reached its natural limit, but what Nanubhai and I are arguing is that there is another leg, and that this is investment, and then, of course, the secondary consumer multipliers. So the place where Goldilocks may actually get to eat all that honey is much more likely to be India, since the push-start which came from the consumer demand leg could now move over to a full throttle investment one. External global push could be as important here as anything internal IMHO (don't forget the Dooley at al debt swap thing, maybe I should come back to this in another moment).

I would say that this is a question of the irresistible force (global push) meeting the moveable object (the mountain of rural labour just waiting to flow towards it in India). All this more than likely simply needs one big push.

"Even with the current pace of growing infrstructure

(still at an incipient phase) for us to engage in socio-economic

theorizing about how many hundred million of India's villagers would need to move from agri to industry/svcs and in how much time, is still too fanciful and hardly conclusive! "

I think Aninda here hits the proverbial nail on the proverbial head. I recently used the expression "when the damn breaks" somewhere, and this would be exactly the point, economic development almost always involves large scale internal migrations. Spain in the 1960s would be a perfect example, China in 1998 would be another, remember Andy Xie estimated that there were some 200 million people out of work and on the move at that point. Of course this river has now largely stopped flowing in China, and as Nandan was also pointing out to me last nigh, wage inflation in China is on the rise. This, however, won't push them out of business, but will simply lead to structural reform and a shift up the value chain as happens everywhere else.

But this does begin to open up a hole at the bottom for India. And the rural population is getting desperate. Growing numbers and a diminishing share of GDP are simply not sustainable, with or without the well-known conservatism of the rural poor in India.

So I am saying they ARE going to move (yes, I am sticking my neck out, but this will be testable), and if they start to move then the network feedback process will be massive. Indeed this can all become quite dramatic at some point.

Of course I could be wrong, but everything I feel about this points in this direction. What we need is to start to gather data here. Odd articles in the WSJ are neither here or there in this sense.

"Is it appropriate to boost demand, socio-political expectations and promises of economic and financial abundance NOW with the hunch (regardless of how stronglysuch a 'hunch' might be felt) that the supply-side will catch up? "

No it isn't. I am not saying this. What we may well see in the short term is increasing hardship for hundreds of millions of people. The river of births which have been taking place in the north virtually guarantee this. Look at this post from New Economist:

China's poor grew poorer at a time when the country was growing substantially wealthier, an analysis by World Bank economists has found. The real income of the poorest 10 per cent of China's 1.3bn people fell by 2.4 per cent in the two years to 2003, the analysis showed, a period when the economy was growing by nearly 10 per cent a year. Over the same period, the income of China's richest 10 per cent rose by more than 16 per cent.

I would say that it is almost inevitable that India repeat this experience, ie that many people get worse off short term before they get better long term.

And indeed today there is more news to this effect:

China’s income gap grows despite pledges

China’s widening income gap is approaching Latin American levels, according to a report by the Chinese Academy of Social Sciences, a state think-tank.

The development flies in the face of two years of efforts by China’s leaders to make addressing the gap between rich and poor a priority. Hu Jintao, China’s president, has pledged to promote “social equality”. Although the government has abolished an agricultural tax and pledged to expand the social security network in both rural and urban areas, it is under considerable pressure to announce more ambitious policies.

The think tank report is the latest by governmental or international groups to conclude that economic inequality is rising rapidly in China, despite the continued growth in the economy and the millions of people who have been lifted out of poverty.

and please don't miss this bit which, IMHO, is going to become ever so important in the developing world:

In its annual report on social development in China, the Cass academics also warned rising medical costs were becoming an ever-greater problem and were pushing some back into poverty.

According to the Cass report, rising healthcare costs have become a big concern among Chinese, with medical expenses now accounting for 11.8 per cent of household consumption, more than transport or education.

“This is a very high percentage, even compared to developed countries,” said Li Peilin, a sociologist at Cass and the report’s editor. “Soaring medical costs have plunged many rural and urban Chinese back into poverty.”

"The real economic underpinnings for a sustained surge in productivityand capital deepening growth is there. But the political/policy underpinnings to manage such a referenced 'underpinning' along side socio-political and investor expectations, still, in my view, fall short."

Well this is the big issue isn't it. I don't think that any of us doubt the weaknesses on the policy front, the key problem seems to be just how much growth can be achieved despite this.

I mean if we call the rate of GDP growth Y*, then we could say something like this:

Y* = f(L*, EL*, T*, I*)

Where L is labour force, EL is effective labour force (ie a human capital component), T is the technology level, and I is a measure of institutional quality. Now the difficulty is just what weighting to we give to each of these. L isn't hard to estimate, since it is to some extent determined by the demographics, but obviously not by this alone, since the growth in labour participation will also to some extent be influenced by I, eg just how dynamic the labour market is and how good at job creation it is.

The others are much less easy to get to grips with. EL can be measured by changes in formal education, but in a rapidly growing economy like India's, and with a rapid expansion in unskilled jobs, learning by doing can be even more important, and again in the north of India maybe you need another proxy like H (health) to assess just what can and can't be done.

T will depend a lot on the investment rate, and this is what we will need to watch closely in 2007, but again there are reasons ex-India to imagine that the flow of funds can increase significantly, since the quantity of investment opportunities in relation to the availability of funds may be constrained (the investment dearth, which is simply the other side of the savings glut). So any assessment of trend growth in India would need to take into account the external environment, and how this is changing, and just how rapidly India is integrating with that global environment (which again, of course, depends on I*).

What we don't know is how rapidly the institutional environment can change, but one thing which should be borne in mind is the fact that a market economy is effectively a self-organising system. In an environment where so many people put the emphasis on markets, it is strange how people often tend to ignore this fact (or refer us to the law of unintended consequences). It is precisely because outcomes can RARELY be the intended ones that markets are so important, indeed this is the whole theoretical underpinning of the market economy case, and of course the basis for the critique of soviet-style planned economies (although, of course, don't miss what France has actually managed to do with a far higher planning element than the US).

Which is not at all to say that you don't need to develop a high quality institutional environment, but is to say that when the river is flowing fast enough, the water will simply work its way round the blockages. This is what we may be about to witness in India.

Also, if we look at the growth theory correlation studies of the 1990s, what is surprising is just how LITTLE correlation people were able to find about institutional factors, apart from Health (which was the strongest correlate) and education.

So I think we do need to be careful here.

"Here, too, excessive optmism needs to be tempered by India's rich history of mishaps, mismanagement, corruption, etc."

Well look, all of this is certainly true, but just how much of a guide to the future is the past here? Just how rapidly can things change? We simply don't know, but all the recent evidence points to the fact that things are changing much more quickly today - everywhere - than they were 20 years ago, for example. So if there are to be surprises here, oughtn't we to expect them on the upside?

"I believe it is incorrect to say India's politics do not matter

anymore, or that its economy is increasingly divorced from political or policy constraints. "

No, but I don't think that any of us are going quite that far, we are simply asking the fairly reasonable question of, even on the slightly worse case scenarios, what could we expect?

There is an unusual comparison here which springs to mind, since most of the analysts out there seem absolutely ready to buy the Goldilocks Germany and Japan stories, whilst not buying the Indian one. I would suggest they apply the same criteria to their analyses of Germany and Japan that they apply to India, not the other way round.

But why does this difference exist? I think it exists because people tend (following academic theory prejudices - Darren Acemoglu for eg , who IMHO simply hasn't got a clue what he is doing in the last life expectancy/fertility correlate he ran, but more on this in another moment) to give a high weighting in the little equation I outline above to the I factor, and don't think enough about the structural components of L* and EL*. You need to think about BOTH, but my big beef is that one set of parameters are being ignored here, and in BOTH the Japan and the India cases, which are really only two different sides of the same coin.

"Demand side growth, financial market valuations and social

expectations are in danger of pulling ahead of supply side capacities (and political commitments)."

I think we need to differentiate pretty rigourously when we refer to 'demand' here, as I have often pointed out to Brad Setser, you need to think about BOTH investment and consumer demand. Now I think we are all agreed that the consumer driven end of things has now reached its natural limit, but what Nanubhai and I are arguing is that there is another leg, and that this is investment, and then, of course, the secondary consumer multipliers. So the place where Goldilocks may actually get to eat all that honey is much more likely to be India, since the push-start which came from the consumer demand leg could now move over to a full throttle investment one. External global push could be as important here as anything internal IMHO (don't forget the Dooley at al debt swap thing, maybe I should come back to this in another moment).

I would say that this is a question of the irresistible force (global push) meeting the moveable object (the mountain of rural labour just waiting to flow towards it in India). All this more than likely simply needs one big push.

"Even with the current pace of growing infrstructure

(still at an incipient phase) for us to engage in socio-economic

theorizing about how many hundred million of India's villagers would need to move from agri to industry/svcs and in how much time, is still too fanciful and hardly conclusive! "

I think Aninda here hits the proverbial nail on the proverbial head. I recently used the expression "when the damn breaks" somewhere, and this would be exactly the point, economic development almost always involves large scale internal migrations. Spain in the 1960s would be a perfect example, China in 1998 would be another, remember Andy Xie estimated that there were some 200 million people out of work and on the move at that point. Of course this river has now largely stopped flowing in China, and as Nandan was also pointing out to me last nigh, wage inflation in China is on the rise. This, however, won't push them out of business, but will simply lead to structural reform and a shift up the value chain as happens everywhere else.

But this does begin to open up a hole at the bottom for India. And the rural population is getting desperate. Growing numbers and a diminishing share of GDP are simply not sustainable, with or without the well-known conservatism of the rural poor in India.

So I am saying they ARE going to move (yes, I am sticking my neck out, but this will be testable), and if they start to move then the network feedback process will be massive. Indeed this can all become quite dramatic at some point.

Of course I could be wrong, but everything I feel about this points in this direction. What we need is to start to gather data here. Odd articles in the WSJ are neither here or there in this sense.

"Is it appropriate to boost demand, socio-political expectations and promises of economic and financial abundance NOW with the hunch (regardless of how stronglysuch a 'hunch' might be felt) that the supply-side will catch up? "

No it isn't. I am not saying this. What we may well see in the short term is increasing hardship for hundreds of millions of people. The river of births which have been taking place in the north virtually guarantee this. Look at this post from New Economist:

China's poor grew poorer at a time when the country was growing substantially wealthier, an analysis by World Bank economists has found. The real income of the poorest 10 per cent of China's 1.3bn people fell by 2.4 per cent in the two years to 2003, the analysis showed, a period when the economy was growing by nearly 10 per cent a year. Over the same period, the income of China's richest 10 per cent rose by more than 16 per cent.

I would say that it is almost inevitable that India repeat this experience, ie that many people get worse off short term before they get better long term.

And indeed today there is more news to this effect:

China’s income gap grows despite pledges

China’s widening income gap is approaching Latin American levels, according to a report by the Chinese Academy of Social Sciences, a state think-tank.

The development flies in the face of two years of efforts by China’s leaders to make addressing the gap between rich and poor a priority. Hu Jintao, China’s president, has pledged to promote “social equality”. Although the government has abolished an agricultural tax and pledged to expand the social security network in both rural and urban areas, it is under considerable pressure to announce more ambitious policies.

The think tank report is the latest by governmental or international groups to conclude that economic inequality is rising rapidly in China, despite the continued growth in the economy and the millions of people who have been lifted out of poverty.

and please don't miss this bit which, IMHO, is going to become ever so important in the developing world:

In its annual report on social development in China, the Cass academics also warned rising medical costs were becoming an ever-greater problem and were pushing some back into poverty.

According to the Cass report, rising healthcare costs have become a big concern among Chinese, with medical expenses now accounting for 11.8 per cent of household consumption, more than transport or education.

“This is a very high percentage, even compared to developed countries,” said Li Peilin, a sociologist at Cass and the report’s editor. “Soaring medical costs have plunged many rural and urban Chinese back into poverty.”

Productivity and Growth in India and China

Aninda sent me a link to this article by Sunil Jain:

Is the Left right on China?

Reading through the first paragraph of Jain's piece again, I cannot help but be stopped in my tracks by the first paragraph:

"It is true, some of the charm has worn off the Chinese miracle as it has become obvious the real miracle is not so much the economy's productivity as it is the large amounts of capital virtually being thrown in to get growth."

So the real question isn't really why is China getting comparatively little in the way of productivity return from investments, but rather why is so much capital being 'virtually' thrown into China in the first place? Unfortunately Jain doesn't return to this topic in the article.

The same goes for the Thai Baht issue, why do so many people want to throw money at Thailand?

If we could begin to answer this, then my feeling is that everything would fall much better into place.

Ajay Shah had a short piece on this last week, but like almost everyone else he only really thinks about the issue in terms of the ineffectiveness of capital controls, and doesn't get into the problem of why in 1998 capital was trying to move in one direction, and now it is trying to move in another.

I think at the end of the day Lardy's analysis is pretty superficial, but I guess one day I am going to need to justify having said this.

But if you look at this:

"Lardy's talk at the NCAER was about the progress, or the lack of it, that China was making in its attempt to change its growth model enough to be driven more by domestic consumption than by investment growth, despite the fact that the central leadership favours this."

What I'd like to know is why there are so many 'fair-weather' market economists in the US? I mean according to Milton Friedman, I thought the best thing was just to let the market get on with it, and for government to get out of the way as much as possible (I don't really go too far down the road with Friedman, but his instincts are sound enough here I think). So where the hell does all this 'growth model' and central leadership favoritism come in? I mean growth is just to big an issue to be handled by government, especially a switch from investment driven to consumption driven processes. Governments can't simply manipulate this IMHO, they can add a little here, subtract a little there, but in the end the market mechanisms are the best way to regulate this.

Of course there are issues about the currency peg, but my guess is that even without the peg China would still be pretty investment driven at this stage.

On the other hand there are just so many things in China that don't look anything like a market economy, so maybe all I am suggesting is that the critics might do better to argue that the Chinese administration continue deregulating rather than suggest they actively promote some sort of new growth model.

At the end of the day we always seem to come back to the issue of why the international financial markets want to send so much money to invest in China, this is the big question.

Looking at Jain's argument in more detail, one of my guesses in the Chinese context is that you really need to separate out the state-owned enterprises, or the all Chinese ones with state participation from the joint ventures with foreign capital. In the latter it is quite probable that productivity can be rising much more rapidly.In fact it is probably the case that the whole export sector is much more productive than the rest of the economy.

"total factor productivity in China grew 3.8 per cent per annum in the 1978-93 period"

I'm a bit nervous about numbers from this era, especially looking at what we now know about Eastern Europe.

"and this then fell to 2.7 per cent per annum in the 1994-2004 period."

Again this seems to aggregate over just the wrong period. What would be nice would be to see the data for 1994-1999 (up to when China really started to take off) with the 2000-2004 data. That would really be interesting.

Obviously the other interesting thing is what happens next. China has grown by leveraging a large increase in labour inputs, indeed a very large increase in very cheap labour inputs. This labour may now well migrate through the sectors.

And one final quibble, why does everyone seem to want to forget what happened in the Tigers so quickly? China may be much bigger, but structurally the process may not be *that* different.

Basically I would forget what was supposed to have been happening before 1994, and I would also be remembering the findings of Alwyn Young that growth in the Tigers in the first instance had very little in the way of a productivity component, growth was largely about accumulating factor inputs as we are seeing in China now. The rapid improvements in TFP readings came a little later as they shifted economic activity up through the sectors, which I guess is what we may now be about to see in China.

India is still way back down the line when thought of in these terms.

I think the inequality points are Jain makes are interesting, but I'm just not sure the current situation in India is sustainable. I fear things may well get worse for many before they get better. If in doubt about this just look at the fiscal deficit situation. More on this in posts to come.

Is the Left right on China?

Reading through the first paragraph of Jain's piece again, I cannot help but be stopped in my tracks by the first paragraph:

"It is true, some of the charm has worn off the Chinese miracle as it has become obvious the real miracle is not so much the economy's productivity as it is the large amounts of capital virtually being thrown in to get growth."

So the real question isn't really why is China getting comparatively little in the way of productivity return from investments, but rather why is so much capital being 'virtually' thrown into China in the first place? Unfortunately Jain doesn't return to this topic in the article.

The same goes for the Thai Baht issue, why do so many people want to throw money at Thailand?

If we could begin to answer this, then my feeling is that everything would fall much better into place.

Ajay Shah had a short piece on this last week, but like almost everyone else he only really thinks about the issue in terms of the ineffectiveness of capital controls, and doesn't get into the problem of why in 1998 capital was trying to move in one direction, and now it is trying to move in another.

I think at the end of the day Lardy's analysis is pretty superficial, but I guess one day I am going to need to justify having said this.

But if you look at this:

"Lardy's talk at the NCAER was about the progress, or the lack of it, that China was making in its attempt to change its growth model enough to be driven more by domestic consumption than by investment growth, despite the fact that the central leadership favours this."

What I'd like to know is why there are so many 'fair-weather' market economists in the US? I mean according to Milton Friedman, I thought the best thing was just to let the market get on with it, and for government to get out of the way as much as possible (I don't really go too far down the road with Friedman, but his instincts are sound enough here I think). So where the hell does all this 'growth model' and central leadership favoritism come in? I mean growth is just to big an issue to be handled by government, especially a switch from investment driven to consumption driven processes. Governments can't simply manipulate this IMHO, they can add a little here, subtract a little there, but in the end the market mechanisms are the best way to regulate this.

Of course there are issues about the currency peg, but my guess is that even without the peg China would still be pretty investment driven at this stage.

On the other hand there are just so many things in China that don't look anything like a market economy, so maybe all I am suggesting is that the critics might do better to argue that the Chinese administration continue deregulating rather than suggest they actively promote some sort of new growth model.

At the end of the day we always seem to come back to the issue of why the international financial markets want to send so much money to invest in China, this is the big question.

Looking at Jain's argument in more detail, one of my guesses in the Chinese context is that you really need to separate out the state-owned enterprises, or the all Chinese ones with state participation from the joint ventures with foreign capital. In the latter it is quite probable that productivity can be rising much more rapidly.In fact it is probably the case that the whole export sector is much more productive than the rest of the economy.

"total factor productivity in China grew 3.8 per cent per annum in the 1978-93 period"

I'm a bit nervous about numbers from this era, especially looking at what we now know about Eastern Europe.

"and this then fell to 2.7 per cent per annum in the 1994-2004 period."

Again this seems to aggregate over just the wrong period. What would be nice would be to see the data for 1994-1999 (up to when China really started to take off) with the 2000-2004 data. That would really be interesting.

Obviously the other interesting thing is what happens next. China has grown by leveraging a large increase in labour inputs, indeed a very large increase in very cheap labour inputs. This labour may now well migrate through the sectors.

And one final quibble, why does everyone seem to want to forget what happened in the Tigers so quickly? China may be much bigger, but structurally the process may not be *that* different.

Basically I would forget what was supposed to have been happening before 1994, and I would also be remembering the findings of Alwyn Young that growth in the Tigers in the first instance had very little in the way of a productivity component, growth was largely about accumulating factor inputs as we are seeing in China now. The rapid improvements in TFP readings came a little later as they shifted economic activity up through the sectors, which I guess is what we may now be about to see in China.

India is still way back down the line when thought of in these terms.

I think the inequality points are Jain makes are interesting, but I'm just not sure the current situation in India is sustainable. I fear things may well get worse for many before they get better. If in doubt about this just look at the fiscal deficit situation. More on this in posts to come.

Saturday, December 23, 2006

Inflation On The Increase

Wholesale inflation accelerated this week in India, to 5.32 percent.

The inflation rate rose to 5.32 percent in the week ended Dec. 9 from 5.16 percent in the previous week, the Ministry of Commerce and Industry said in its weekly statement in New Delhi today. The inflation rate had been estimated at 5.35 percent, according to the median forecast of 10 analysts surveyed by Bloomberg News.

Prime Minister Manmohan Singh's government wants to slow inflation to 4 percent as it faces seven state elections in 2007, the most important in the province of Uttar Pradesh which sends almost a seventh of lawmakers to parliament.

All of this is making the life of the RBI more difficult, since raising interest rates, which is proving difficult enough to do at the long end, only serves to suck in more money, due to the interest rate differential and the anticipated rise in the currency that the inflow produces:

Commercial banks' loans to companies have risen about 29 percent since April 1 from the same period last year, according to central bank data. The pace is close to the fastest since the Reserve Bank started collating information in 1971.

To curb inflation, the Reserve Bank of India announced on Dec. 8 an increase in the amount of cash lenders have to set aside to cover deposits, trying the third different policy tool in five months to curb inflation.

A higher cash-reserve limit will leave lenders with 135 billion rupees ($3 billion) less cash, and help slow lending, according to the central bank.

The move came after interest rate increases by the central bank failed to slow the record pace of bank lending. The central bank increased the overnight lending rate for the fourth time this year on Oct. 31. It raised its overnight borrowing rate three times this year in a bid to make fewer funds available to banks for lending.

The inflation rate rose to 5.32 percent in the week ended Dec. 9 from 5.16 percent in the previous week, the Ministry of Commerce and Industry said in its weekly statement in New Delhi today. The inflation rate had been estimated at 5.35 percent, according to the median forecast of 10 analysts surveyed by Bloomberg News.

Prime Minister Manmohan Singh's government wants to slow inflation to 4 percent as it faces seven state elections in 2007, the most important in the province of Uttar Pradesh which sends almost a seventh of lawmakers to parliament.

All of this is making the life of the RBI more difficult, since raising interest rates, which is proving difficult enough to do at the long end, only serves to suck in more money, due to the interest rate differential and the anticipated rise in the currency that the inflow produces:

Commercial banks' loans to companies have risen about 29 percent since April 1 from the same period last year, according to central bank data. The pace is close to the fastest since the Reserve Bank started collating information in 1971.

To curb inflation, the Reserve Bank of India announced on Dec. 8 an increase in the amount of cash lenders have to set aside to cover deposits, trying the third different policy tool in five months to curb inflation.

A higher cash-reserve limit will leave lenders with 135 billion rupees ($3 billion) less cash, and help slow lending, according to the central bank.

The move came after interest rate increases by the central bank failed to slow the record pace of bank lending. The central bank increased the overnight lending rate for the fourth time this year on Oct. 31. It raised its overnight borrowing rate three times this year in a bid to make fewer funds available to banks for lending.

Thursday, December 21, 2006

Growth 2007

Credit Suisse is forecasting 10% growth in India next year. They may be right, but my feeling is that it is more likely to be because of s shift into infrastructure than because of the consumer demand element:

India will overtake China next year as the world's fastest-growing major economy on rising consumer and government spending, Credit Suisse's chief Asia economist Dong Tao said.

Credit Suisse raised its 2007 growth forecast for India's $775 billion economy, Asia's fourth biggest, to 10 percent from 8.5 percent, Tao said. China's $2.2 trillion economy is expected to grow 9.9 percent next year from 10.4 percent in 2006, he said.

India had the highest average salary increase in the Asia- pacific region in 2006 gaining 13.8 percent in 2006 compared with 14.1 percent gain in 2005, according to human-resources consulting firm Hewitt Associates Inc. Salaries in India may rise by 12.3 percent to 15 percent in 2007.

``The private consumption story in India is growing,'' Credit Suisse's Tao said in a phone interview from Hong Kong today. ``At this moment, India surpassing China as the world's fastest growing major economy is a possibility. India is more resilient toward a global slowdown compared to China.''

India now wants to draw investments from Japan and narrow the gap in overseas funding with China, which began unshackling its economy in 1978, 13 years before India. India's northern neighbor got $60 billion of foreign direct investment in 2005 compared with India's $7.5 billion.

``Capacity additions in the steel, auto, metals and consumer goods sector seem to be gathering pace in response to strong consumer spending and a pick-up in public investment spending in the power, roads and highway sectors,'' Tao said.

Industries such as steel and cement are also benefiting from Prime Minister Singh's decision to increase spending on roads, ports and other infrastructure by a quarter to 992 billion rupees ($22 billion) in the year that started April 1 in a bid to attract overseas manufacturing companies and spur growth to 10 percent over a decade.

Surpassing China's expansion rate for the first time at least two decades may help lure the overseas investment India needs to replace dilapidated port and roads and create manufacturing jobs. Prime Minister Manmohan Singh needs rapid growth to lift 350 million people out of poverty in the world's second-most populous nation.

India will overtake China next year as the world's fastest-growing major economy on rising consumer and government spending, Credit Suisse's chief Asia economist Dong Tao said.

Credit Suisse raised its 2007 growth forecast for India's $775 billion economy, Asia's fourth biggest, to 10 percent from 8.5 percent, Tao said. China's $2.2 trillion economy is expected to grow 9.9 percent next year from 10.4 percent in 2006, he said.

India had the highest average salary increase in the Asia- pacific region in 2006 gaining 13.8 percent in 2006 compared with 14.1 percent gain in 2005, according to human-resources consulting firm Hewitt Associates Inc. Salaries in India may rise by 12.3 percent to 15 percent in 2007.

``The private consumption story in India is growing,'' Credit Suisse's Tao said in a phone interview from Hong Kong today. ``At this moment, India surpassing China as the world's fastest growing major economy is a possibility. India is more resilient toward a global slowdown compared to China.''

India now wants to draw investments from Japan and narrow the gap in overseas funding with China, which began unshackling its economy in 1978, 13 years before India. India's northern neighbor got $60 billion of foreign direct investment in 2005 compared with India's $7.5 billion.

``Capacity additions in the steel, auto, metals and consumer goods sector seem to be gathering pace in response to strong consumer spending and a pick-up in public investment spending in the power, roads and highway sectors,'' Tao said.

Industries such as steel and cement are also benefiting from Prime Minister Singh's decision to increase spending on roads, ports and other infrastructure by a quarter to 992 billion rupees ($22 billion) in the year that started April 1 in a bid to attract overseas manufacturing companies and spur growth to 10 percent over a decade.

Surpassing China's expansion rate for the first time at least two decades may help lure the overseas investment India needs to replace dilapidated port and roads and create manufacturing jobs. Prime Minister Manmohan Singh needs rapid growth to lift 350 million people out of poverty in the world's second-most populous nation.

India's Reserves and Infrastructure

This is a very strange story. They want to try and recycle reserves to finance infrastructure projects. Now either this is a piece of midwinter madness, or they have thought of something which neither I nor anyone else has:

India is exploring whether it can use a part of its near-record foreign-exchange reserves of $175.5 billion to fund the nation's bid to modernize roads, ports and airports, the finance minister said.