In a year-end review released this week, Kamal Nath, India’s minister of commerce and industry, said FDI inflows were expected to surpass $11bn in 2006-07, compared with $5.5bn the previous year.

However as the article also notes this figure is way below the Chinese one in absolute terms:

Foreign direct investment (FDI) in India this fiscal year is expected to double to $11bn but will still be dwarfed by inflows to neighbouring Asian countries such as China and Singapore,

So far, so good, but as Surjit Bhalla points out, you need to think about both FDI (foreign direct investment) and FII (foreign institutional investment), Rasmi Banga agrees:

"However, Rashmi Banga, an economist at the United Nations Conference on Trade and Development, based in New Delhi, pointed out that foreign investment could enter India through other channels such as foreign institutional investors (FII)."

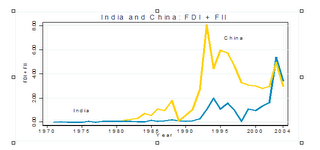

Now the interesting thing, as this chart from Surjit Bhalla shows is that the combined totals of FDI and FII for India and China as a proportion of GDP are not that different:

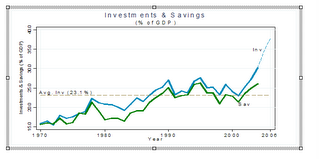

However, in addition to FDI and FII we also need to consider the domestic savings situation, and as we can see this has been on a long term secular rise in India for some time now:

Further there are inward capital flows from NRIs (non-resident Indians)to consider and India Economy Blogger Arjun Swarup:

The housing and real estate boom in India is being driven by NRI inflows into India. In 2005, the inflow was 90,000 crores ($21 billion). For China, which was the second biggest recipient, the number was $5 billion.

So individual flows into India are in fact much bigger than for China, and just why is there this difference, well Arjun suggests (and I'm sure he is right):

The reason for heavy NRI investment into real estate is that they would like to have a long-term view into India, given the upcoming demographic dividend, and the overall growth prospects. So they are buying and selling, creating the market. Additionally, it is the simplest (and safest) way to get a foot in the door right now.

It also needs to bear remembering that land prices in India can only appreciate over the long run ( high density, massive demand, growth concentrated in a few regions). Plus, zoning between commercial and residential areas in most high growth regions continues to be quite weak, and that also pushes up demand significantly.

So at the end of the day FDI is important more for strategic that for volume reasons, and it may be that India will have no shortage of funds for investment projects in 2007, in fact quite the contrary is likely to be the case.

Basically, as Nanuhbai explains in this post, India's per capita incomes can rise either by having a greater share of its population actively working in the cash economy, or by improving the productivity of those who are working, the former will happen almost automatically as funds of any description flow in (given the fairly favourable demographic backdrop) but the latter will only take place effectively (in the short term) through the transfer of technology and management expertise which becomes possible through FDI. This is why upping the volume of FDI is so important for India.

1 comment:

One of the major things about FDI is about stability. FII are unreliable folks and to quote an economist "It takes far more time to liquidate a factory than selling the stocks in the market online" and thus their investments can vanish the moment a bad news comes anywhere in the world.

I personally would want FIIs to go down in Indian investment and more stabler NRI investments & domestic investments in stocks, along with FDI in companies to go up. I'm having this sceptical thing because US could go into recession anytime and any if bubble burst, it could take out money from India to liquidate the losses in this.

FIIs are also more stupider and knee-jerkers like how they crashed the Indian stocks just because Thai government added a regulation, recently. So, we must be more wary of them and while regulation on NRIs & FDIs should be reduced, more regulation on FIIs would help in the long term (though in the short term they will crash the exchange).

Post a Comment